The Market Mood Index (MMI) is a sentiment indicator that reflects the overall mood of market participants. It helps traders and investors gauge whether the market is greedy, fearful, or neutral, aiding in informed decision-making. The Market Mood Index in India is widely used to understand market trends, combining factors like volatility, price momentum, and investor sentiment. By tracking MMI, traders can adjust their strategies based on prevailing market conditions.

In this blog, we will explore what the Market Mood Index is, how it works, its significance in India, and how traders can use it to optimise their trading strategies.

What is the Market Mood Index (MMI)?

The Market Mood Index (MMI) is a sentiment indicator that measures the overall mood of market participants. It helps traders and investors determine whether the market is experiencing extreme fear, fear, neutrality, greed, or extreme greed. By understanding these sentiment shifts, traders can make informed decisions and adjust their strategies accordingly.

The MMI score is calculated using various market factors, including:

- Volatility Index (VIX) – Indicates market fear or stability based on expected price fluctuations.

- Put-Call Ratio (PCR) – Reflects trader positioning in options trading.

- Market Breadth – Measures the number of advancing vs. declining stocks to assess market strength.

- Price Momentum – Tracks recent price movements to determine bullish or bearish sentiment.

How is the Market Mood Index Calculated?

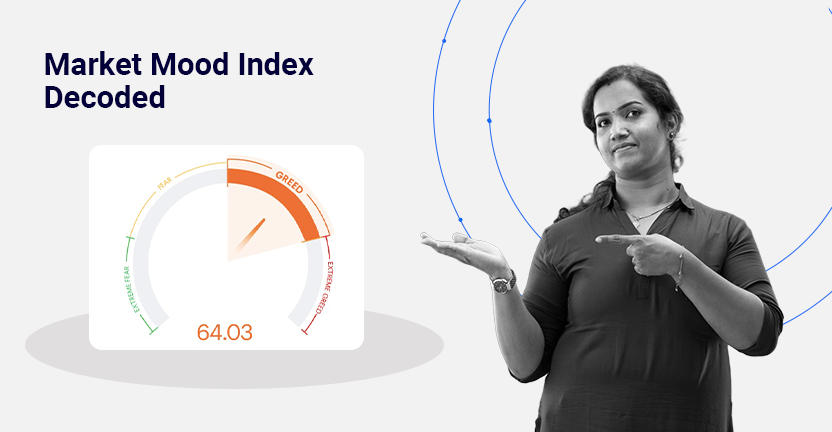

The MMI score ranges from 0 to 100, where lower values indicate a bearish market (fear) and higher values suggest bullish sentiment (greed). It is derived using data from news sentiment, social media trends, trading volumes, and economic indicators to provide a well-rounded market sentiment analysis.

MMI Ranges and Their Meaning

| MMI Range | Market Sentiment | Market Behaviour & Trading Strategy |

| 0-20 (Extreme Fear) | High pessimism, oversold conditions | Markets may be near the bottom; contrarian investors may look for buying opportunities. |

| 20-40 (Fear) | Cautious sentiment, low confidence | Investors remain defensive; risk-hedging strategies are preferred. |

| 40-60 (Neutral) | Balanced sentiment, no clear trend | Markets consolidate; trend-following strategy works well. |

| 60-80 (Greed) | Rising optimism, strong rallies | Investors are bullish; traders should manage risk and set stop-loss orders. |

| 80-100 (Extreme Greed) | Market euphoria, potential overvaluation | There is a high risk of correction; traders should be cautious and book profits. |

How is the Market Mood Index Used in India?

Traders and institutional investors widely track MMI in India to understand market sentiment shifts. Several factors influence MMI in Indian markets, including:

Key Factors Affecting MMI in India:

- FII/DII Activity – Foreign and domestic institutional investor participation significantly impacts market sentiment.

- Economic Data – GDP growth, inflation rates, and RBI policy decisions shape investor outlook.

- Global Market Trends – Movements in US, European, and Asian markets influence Indian indices.

- News & Social Media Sentiment – Headlines, political developments, and investor sentiment on digital platforms affect MMI scores.

Why is MMI Important for Indian Traders?

- Identifies Market Cycles – Helps traders recognise overbought or oversold conditions.

- Aids in Risk Management – Enables traders to adjust exposure based on market mood.

- Improves Investment Decisions – Provides an additional layer of sentiment analysis for stock selection.

How Does the Market Mood Index Affect Trading Strategies?

Traders use MMI trends to adjust their investment approach based on the market mood:

1. Extreme Fear (0-20) – Market pessimism, possible reversal

- Investors are selling aggressively due to negative news, global crises, or economic downturns.

- Contrarian traders may see this as a buying opportunity to acquire fundamentally strong stocks at lower prices.

- Historical trends suggest markets tend to recover from extreme fear levels over time.

2. Fear (20-40) – Cautious market sentiment, consolidation phase

- Investors are hesitant to take new positions, and trading volumes may decline.

- Defensive stocks, gold, and government bonds become more attractive.

- Traders use hedging strategies such as options to manage downside risk.

3. Neutral (40-60) – Market stabilisation and trend-following strategies work

- This phase indicates a lack of clear sentiment, with buyers and sellers active.

- Markets consolidate before making a strong move in either direction.

- Trend-following traders rely on technical indicators like moving averages and RSI to determine trade opportunities.

4. Greed (60-80) – Bullish sentiment, rising market participation

- Optimism increases, and investors aggressively buy stocks.

- Momentum trading strategies work well in this phase as buying interest remains strong.

- Traders should start using stop-loss orders to protect profits in case of sudden corrections.

5. Extreme Greed (80-100) – Market euphoria, high correction risk

- Excessive optimism drives valuations higher, and speculative activity dominates the market.

- Historical patterns suggest that markets often correct after prolonged extreme greed periods.

- Traders should book profits and reduce high-risk positions to safeguard gains.

By tracking MMI trends, traders can anticipate potential turning points and position themselves accordingly.

Making Informed Trading Decisions with MMI

The Market Mood Index (MMI) is a valuable sentiment indicator, helping traders and investors gauge whether the market is greedy, fearful, or neutral. By integrating MMI into their trading approach, market participants can enhance risk management, trade timing, and investment decision-making.At Streetgains, we help traders navigate market sentiment effectively by providing data-driven research and actionable insights. Understanding MMI alongside technical and fundamental analysis can empower traders to make more confident investment decisions.

Disclaimer:

The content in this blog is intended for informational purposes only and does not constitute investment advice, stock recommendations, or trade calls by Streetgains. The securities and examples mentioned are purely for illustration and are not recommendatory.

Investments in the securities market are subject to market risks. Please read all related documents carefully before investing.

What is the Market Mood Index (MMI)? FAQs:

MMI is calculated using indicators like Volatility Index (VIX), Put-Call Ratio (PCR), market breadth, and price momentum. These factors collectively determine whether market sentiment is fearful, neutral, or greedy.

MMI helps traders and investors gauge market sentiment, making it easier to adjust trading strategies. It is a risk management tool that helps traders identify potential market reversals and trend strength.

By analysing investor behaviour, MMI can indicate market turning points. Extreme fear may signal a buying opportunity, while extreme greed can suggest an overbought market with correction risks.

MMI ranges from 0 to 100, with categories such as:

- Extreme Fear (0-20) – High pessimism, possible rebound.

- Fear (20-40) – Weak sentiment, the cautious approach needed.

- Neutral (40-60) – Balanced market sentiment.

- Greed (60-80) – Bullish phase, strong momentum.

Extreme Greed (80-100) – Overvalued market, correction risk.

MMI combines multiple sentiment indicators like VIX and PCR, making it more comprehensive than standalone indicators. It provides a simplified overview of market mood, whereas others may focus on specific aspects like volatility or options data.

While MMI is primarily a short-term market sentiment tool, it can help long-term investors identify optimal entry and exit points based on extreme market emotions, aiding in better portfolio management.

At Streetgains, we provide well-researched insights and real-time market sentiment analysis to help traders make informed decisions. Our research integrates MMI with technical and fundamental analysis, ensuring a data-driven approach to trading.

FAQs:

-

1. How to earn money daily from trading?

Earning money daily from trading involves strategies like day trading, where traders capitalise on small price movements within the same day. Success requires real-time market analysis, quick decision-making, and risk management.

-

2. How to earn money from equity trading?

To earn money from equity trading, you need to buy stocks at a lower price and sell them at a higher price. Success depends on researching companies, analysing stock trends, and using technical or fundamental analysis.

-

3. How to earn money from share trading in India?

In India, share trading offers profit potential through buying and selling stocks on exchanges like the NSE and BSE. To maximise returns, traders should use market research, tools like technical analysis, and risk management strategies.

-

4. How to make money from share trading in India?

Making money from share trading involves selecting the right stocks, timing the market, and implementing trading strategies like swing trading or day trading while staying informed about market trends.

-

5. How to transfer money from a trading account to a bank account?

To transfer money from your trading account to your bank, log into your trading platform, navigate to the funds section, and initiate a withdrawal request. The money will typically be credited to your linked bank account in 1 to 3 days.

-

6. How to withdraw money from a trading account?

You can withdraw funds by logging into your trading account, selecting the withdrawal option, and selecting the amount to transfer to your bank account. Ensure your bank account is linked and follow any steps your broker requires.

Subscribe to our Credits-Based Research System:

Pay only for successful research calls!