Latest StreetView

#STREETGAINS #MARKETSVIEW #18OCTOBER2024

October 18, 2024

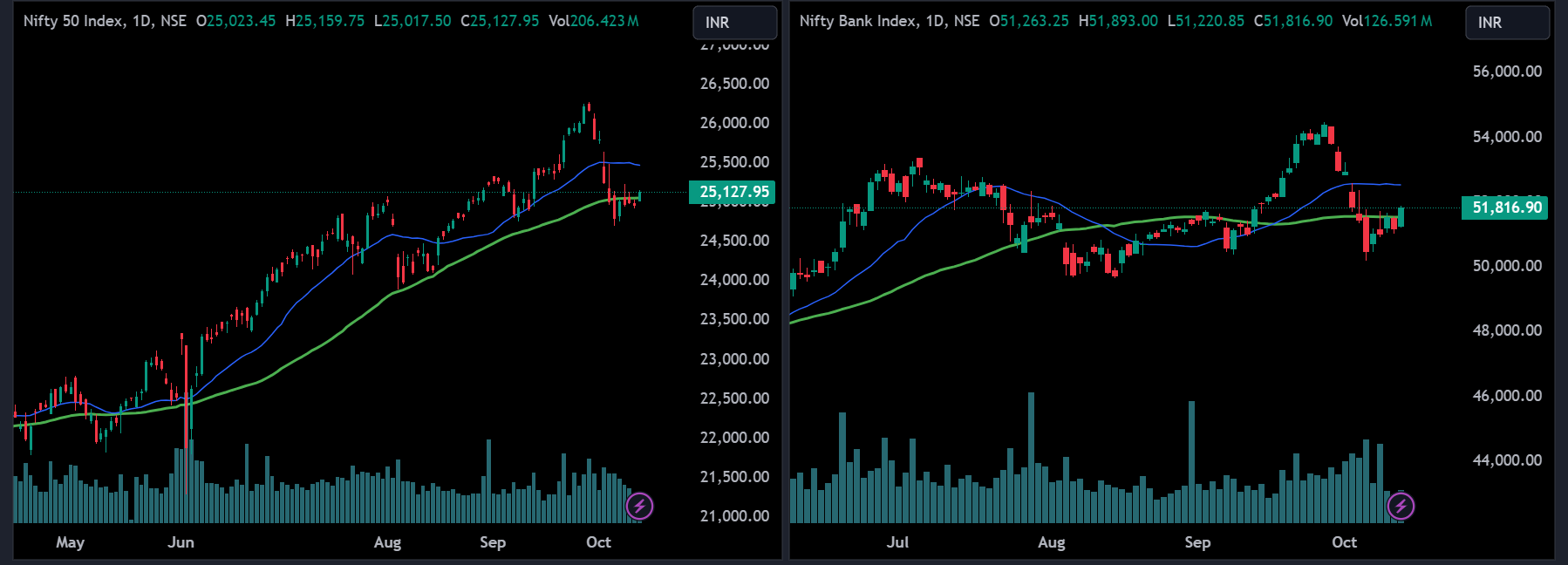

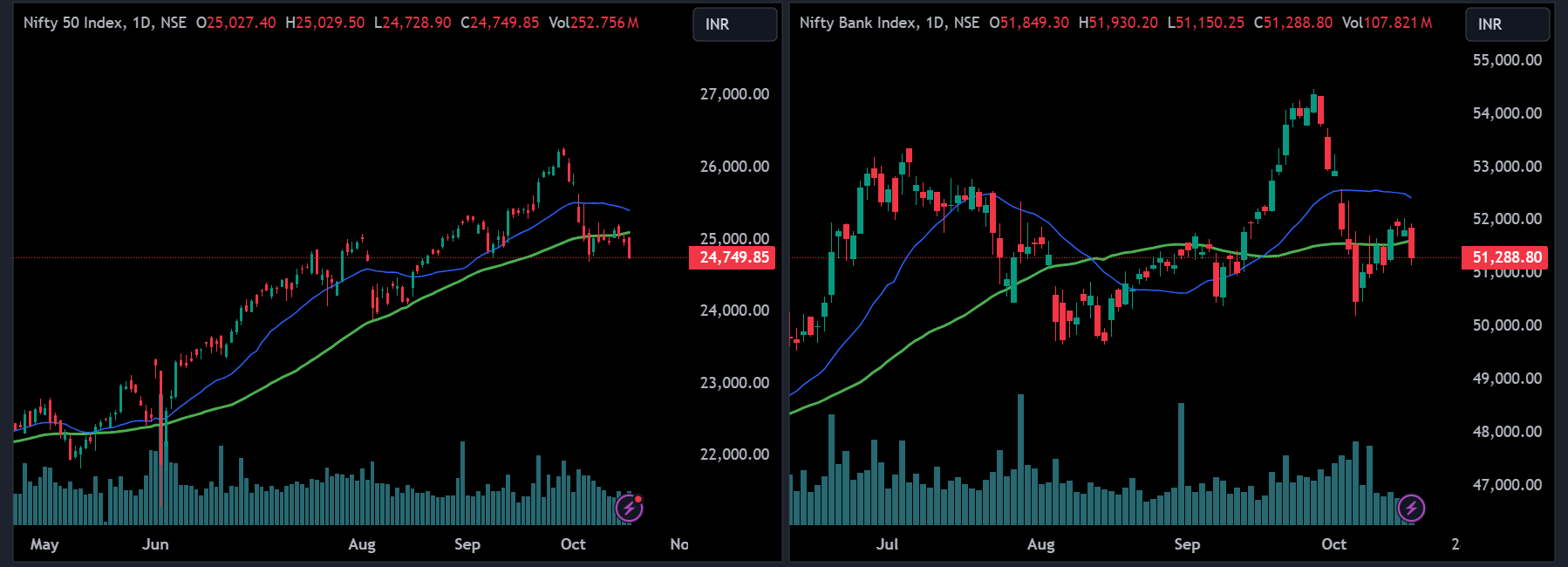

INDIAN MARKETS:

On October 17, At close, the Sensex was down 494.75 points or 0.61 percent at 81,006.61, and the Nifty was down 221.50 points or 0.89 percent at 24,749.80.

US MARKETS:

The S&P 500 lost 1 point, or 0.02%, at 5,841.47 points, while the Nasdaq Composite climbed 6.53 points, or 0.04%, to 18,373.61. The Dow Jones Industrial Average rose 161.35 points, or 0.37%, to 43,239.05.

ASIAN MARKETS:

The Topix increased by 0.32%, while the Nikkei increased by 0.26%. Taiwan's increased by 2.25%, and the Kospi was down 0.23% from the previous close.

OIL & GAS UPDATES:

US West Texas increased 0.47%, while Brent Crude increased by 0.38%.

KEY QUARTERLY EARNINGS:

Infosys Q2 (QoQ):

Profit up 2.2% at Rs 6,506 crore; revenue grows 4.2% to Rs 40,986 crore; EBIT

rises 4.4% to Rs 8,649 crore; margins steady at 21.1%; dollar revenue up 3.8%

to $4,894 million; revenue growth in constant currency at 3.1%. FY25 revenue

guidance raised to 3.75%-4.50%. Interim dividend of Rs 21 per share declared.

Wipro Q2 (QoQ): IT services revenue grows 1.4% to Rs 22,195.7 crore; EBIT rises 3.5% to Rs 3,732.2 crore; margins expand to 16.8%; dollar revenue up 1.3% to $2,660.1 million; constant currency growth at 0.6%. Board approves a 1:1 bonus share issue.

Axis Bank Q2 (YoY): Profit up 18% to Rs 6,918 crore; NII increases 9% to Rs 13,483 crore; provisions rise to Rs 2,204 crore. Gross NPA falls to 1.44%.

LTIMindtree Q2 (QoQ): Profit up 10.3% to Rs 1,251.6 crore; revenue grows 3.2% to Rs 9,432.9 crore; EBIT rises 6.4% to Rs 1,458.2 crore; margins expand to 15.5%. Interim dividend of Rs 20 per share announced.

Polycab India Q2 (YoY): Profit up 3.6% to Rs 445.2 crore; revenue jumps 30.4% to Rs 5,498.4 crore; EBITDA increases 3.7%, but margin drops to 11.5%.

Tata Chemicals Q2 (YoY): Profit drops 46% to Rs 267 crore; revenue flat at Rs 3,999 crore; EBITDA down 24.5%, with margins falling to 15.5%.

KEY STOCKS TO WATCH:

Reliance Industries: Reliance Brands Holding UK has formed a new joint venture with Mothercare Plc, with Reliance holding a 51% stake and Mothercare 49%, to own Mothercare's brand and IP in India and nearby regions.

Adani Enterprises: The company has completed a Rs 4,200 crore QIP to fund capex, debt repayment, and other corporate purposes.

Aether Industries: The company has commissioned another 5 MW of its 15 MW solar project, bringing the total operational capacity to 10 MW.

Zydus Lifesciences: The company received USFDA approval to manufacture Fludrocortisone Acetate tablets used in treating adrenocortical insufficiency and salt-losing adrenogenital syndrome.

Coromandel International: The company has set up a wholly-owned subsidiary in Vietnam to handle agricultural inputs' export, import, and distribution.

FII/DII DATA:

1. FIIs net SOLD Rs 7,421 crore worth shares on 17 October

2. DIIs net BOUGHT Rs 4,979 crore worth shares on 17 October.