Latest StreetView

#STREETGAINS #MARKETSVIEW #14OCTOBER2024

October 14, 2024

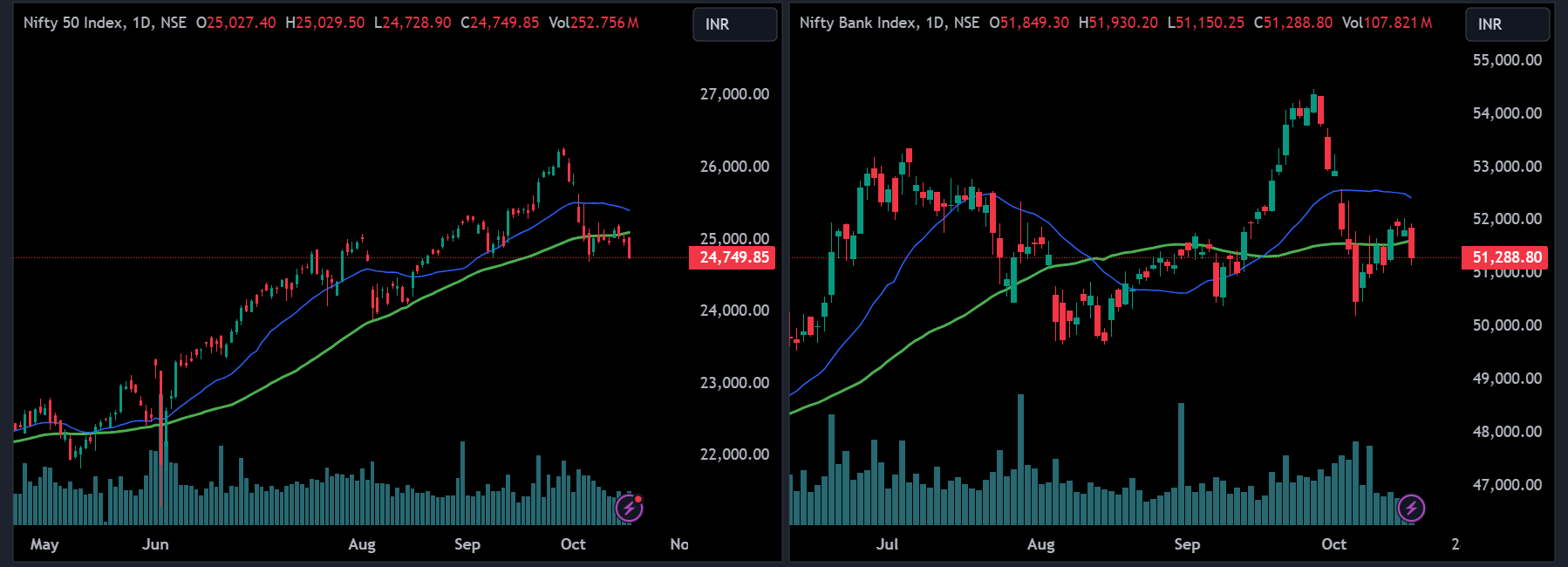

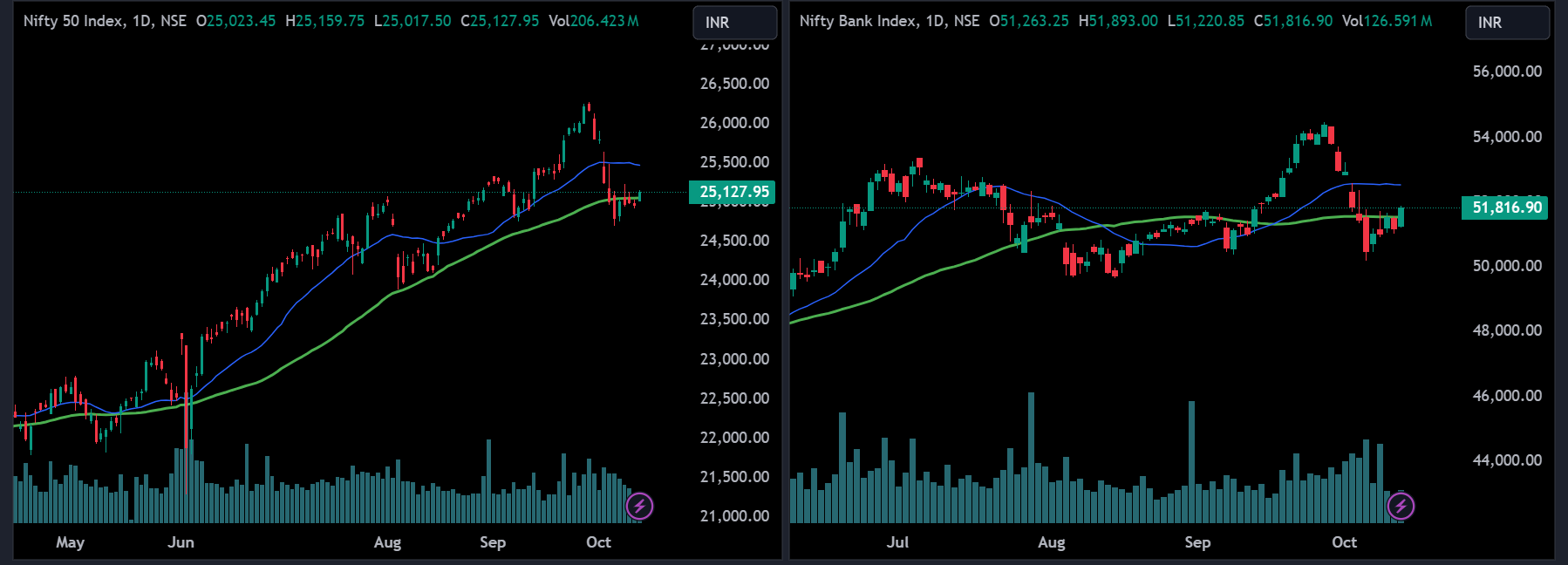

INDIAN MARKETS:

On October 11, At close, the Sensex was down 230.05 points or 0.28 percent at 81,381.36, and the Nifty was down 34.20 points or 0.14 percent at 24,964.30.

US MARKETS:

The Dow Jones Industrial Average rose 409.74 points, or 0.97%, to 42,863.86, the S&P 500 gained 34.98 points, or 0.61%, to 5,815.03 and the Nasdaq Composite gained 60.89 points, or 0.33%, to 18,342.94

ASIAN MARKETS:

Taiwan slipped by 0.46%, and Kospi climbed by 0.51% from the previous close.

OIL & GAS UPDATES:

US West Texas decreased 1.72%, while Brent Crude decreased by 1.70%.

KEY QUARTERLY EARNINGS:

Avenue Supermarts Q2

(Consolidated YoY)

Profit rose 5.8% to ₹659.4 crore, while revenue increased 14.4% to ₹14,444.5 crore. EBITDA grew 8.8% to ₹1,093.8 crore, though margins declined by 40 bps to 7.6%.

Network18 Media and Investments Q2 (Consolidated YoY)

Revenue dropped 2.2% to ₹1,825 crore, with an operating EBITDA loss of ₹179 crore. Subscription revenue surged 43.6% to ₹733 crore, and news business revenue grew 5.9% to ₹445 crore, while the news business turned an EBITDA profit of ₹7 crore.

Hathway Cable and Datacom Q2 (Consolidated YoY)

Profit jumped 28.7% to ₹25.8 crore, with revenue up 6% to ₹512.7 crore. EBITDA increased 4.4% to ₹86.3 crore, though margins declined to 16.8%.

Sula Vineyards Q2 (YoY)

Net revenue decreased 1.3% to ₹141.8 crore. Own brands revenue grew slightly by 0.3% to ₹127.2 crore, while wine tourism revenue rose 1.3% to ₹12.2 crore.

KEY STOCKS TO WATCH:

Ashoka Buildcon

The company secured a project worth ₹2,000 crore from Maharashtra State Road Development Corporation for constructing major bridges across Jaigad, Kundalika, and Bankot Creeks.

Adani Ports and SEZ

Adani Ports completed the acquisition of a 95% stake in Gopalpur Port.

JSW Infrastructure

JSW Port Logistics, a subsidiary, completed the acquisition of a 70.37% stake in Navkar Corporation.

JSW Energy

JSW Energy PSP Two signed an Energy Storage Facility Agreement with MSEDCL for a 1,500 MW hydro energy storage project.

PNC Infratech

The company secured a ₹2,039.6 crore project from CIDCO for road infrastructure development under the NAINA project.

Indoco Remedies

The US FDA classified the inspection of Indoco’s Goa facility as official action indicated (OAI) following a July 2024 inspection.

Easy Trip Planners

The company is acquiring a 30% stake in Rollins International for ₹60 crore. Rollins operates in the wellness and healthcare sector.

FII/DII DATA:

1. FIIs net SOLD Rs 4,162 crore worth shares on 11 October

2. DIIs net BOUGHT Rs 3,730 crore worth shares on 11 October.

Thank you, have a great Trading Day ahead!!