Latest StreetView

#STREETGAINS #MARKETSVIEW #18NOVEMBER2024

November 18, 2024

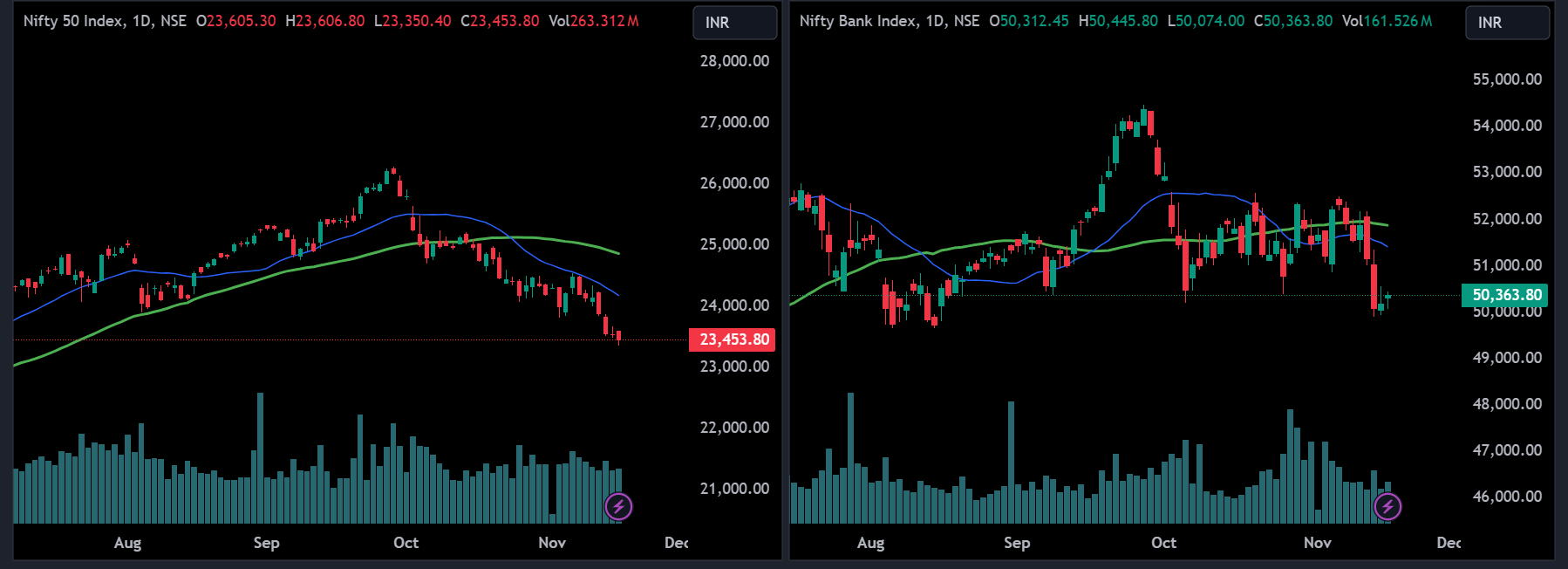

INDIAN MARKETS:

On November 14, At close, the Sensex was down 110.64 points or 0.14 percent at 77,580.31, and the Nifty was down 26.35 points or 0.11 percent at 23,532.70.

US MARKETS:

The Dow Jones Industrial Average fell 305.87 points, or 0.70%, to 43,444.99, the S&P 500 lost 78.55 points, or 1.32%, to 5,870.62 and the Nasdaq Composite dropped 427.53 points, or 2.24%, to 18,680.12.

ASIAN MARKETS:

The previous close saw the Topix decreased by 0.38%, the Nikkei decreased by 0.51%, and the Kospi increased by 2.40%.

OIL & GAS UPDATES:

US West Texas Crude decreased by 0.03%.

Brent Crude increased by 0.11%.

KEY QUARTERLY EARNINGS:

Hero MotoCorp reported a 14.2% increase in profit at Rs 1,203.5 crore, with revenue up 10.8% to Rs 10,463.2 crore, EBITDA rising 14.1% to Rs 1,515.9 crore, and margin expanding by 40 bps to 14.5%.

Grasim Industries saw a 9.3% decline in profit to Rs 721 crore, though revenue grew 18.3% to Rs 7,623.3 crore. EBITDA dropped 45.2% to Rs 325.2 crore, with a margin contraction of 490 bps to 4.3%. Other income surged to Rs 1,293.6 crore, while an exceptional loss of Rs 50 crore was recorded.

Sobha’s profit jumped 74.6% to Rs 26.1 crore, revenue rose 26% to Rs 933.6 crore, and EBITDA increased 2.2% to Rs 77.1 crore, though the margin declined by 190 bps to 8.3%. Finance costs fell to Rs 49.4 crore.

Nazara Technologies saw a 19.6% profit drop to Rs 18.1 crore, with revenue up 7.3% to Rs 318.9 crore. The board approved merging Paperboat Apps with Nazara.

Lemon Tree Hotels’ profit increased 32.8% to Rs 35 crore, with revenue up 24% to Rs 284.4 crore.

Glenmark Pharma posted a profit of Rs 354.5 crore, recovering from a loss of Rs 180.3 crore, while revenue rose 7.1% to Rs 3,433.8 crore.

Balaji Amines reported an 18.1% profit increase to Rs 41 crore, though revenue fell 8.8% to Rs 346.9 crore.

Honasa Consumer reported a Rs 18.6 crore loss, reversing from a Rs 29.4 crore profit, and revenue decreased 6.9% to Rs 461.8 crore.

Muthoot Finance’s profit rose 26.3% to Rs 1,251.1 crore, with net interest income up 35.5% to Rs 2,518 crore.

ITI’s loss narrowed to Rs 70.3 crore as revenue surged 312.3% to Rs 1,016.2 crore.

Crompton Greaves Consumer Electricals’ profit increased 28.5% to Rs 124.9 crore, with revenue up 6.4% to Rs 1,896 crore.

Easy Trip Planners saw a 45.2% profit decline to Rs 25.9 crore, while revenue rose slightly by 2.1% to Rs 144.7 crore.

KEY STOCKS TO WATCH:

Reliance Industries, Viacom18, and Disney have completed the merger of Viacom18’s media and JioCinema businesses with Star India, following necessary approvals. RIL invested Rs 11,500 crore in the JV, with Nita Ambani as Chairperson and Uday Shankar as Vice Chairperson.

ACME Solar's subsidiary secured a Rs 3,753 crore term loan from REC to develop 320 MW of renewable energy projects with SJVN in Rajasthan and Gujarat.

Hindustan Zinc won a composite license for a gold mining block in Rajasthan, making it the preferred bidder for the Dugocha block.

Cyient expanded its partnership with Allegro MicroSystems to develop next-gen automotive magnetic sensors and power semiconductors.

FII/DII DATA:

1. FIIs net SOLD Rs 1,849 crore worth shares on 14 November.

2. DIIs net BOUGHT Rs 2,481 crore worth shares on 14 November.