Latest StreetView

#STREETGAINS #MARKETSVIEW #13NOVEMBER2024

November 13, 2024

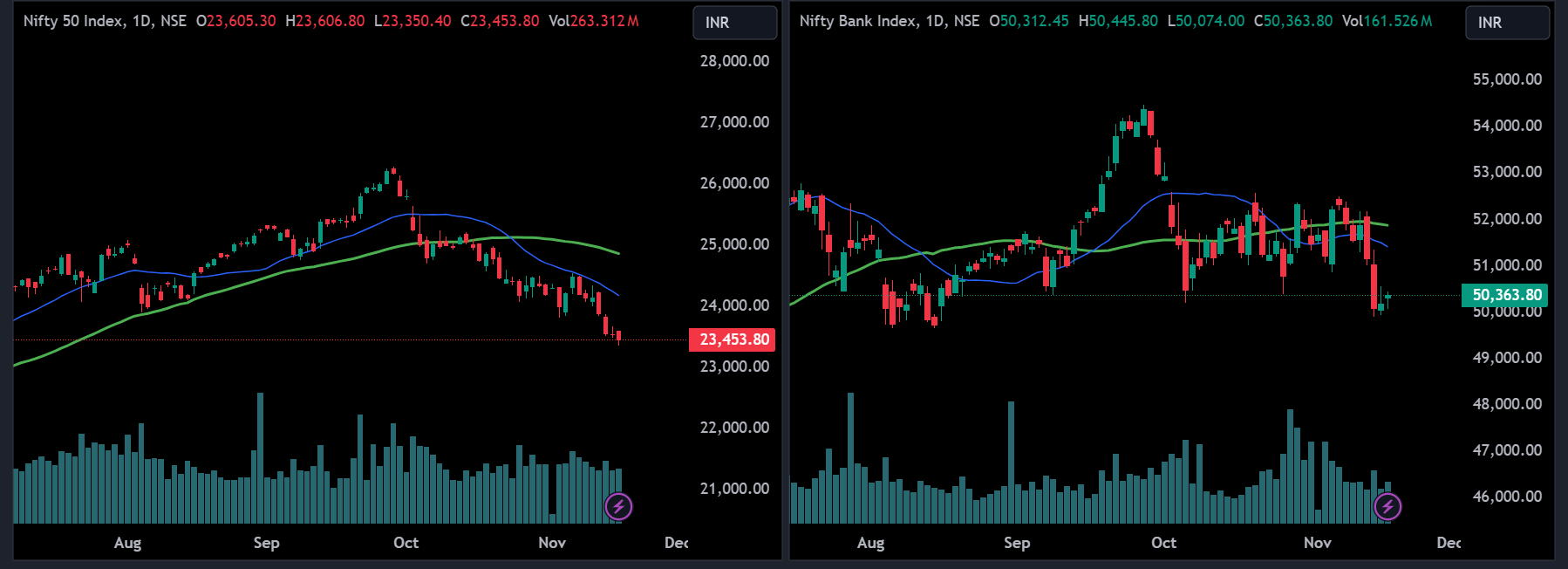

INDIAN MARKETS:

On November 12, At close, the Sensex was down 820.97 points or 1.03 percent at 78,675.18, and the Nifty was down 257.80 points or 1.07 percent at 23,883.50.

US MARKETS:

The Dow Jones Industrial Average fell 382.15 points, or 0.86%, to 43,910.98, the S&P 500 lost 17.36 points, or 0.29%, to 5,983.99 and the Nasdaq Composite lost 17.36 points, or 0.09%, to 19,281.40.

ASIAN MARKETS:

The previous close saw the Topix decreased by 0.70%, the Nikkei decreased by 0.77%, and the Kospi decreased by 1.34%.

OIL & GAS UPDATES:

US West Texas Crude decreased by 0.04%.

Brent Crude decreased by 0.01%.

KEY QUARTERLY EARNINGS:

BSE: Profit up 188% at Rs 346.8 crore (vs. Rs 120.5 crore); revenue up 137.3% at Rs 746.3 crore (vs. Rs 314.5 crore).

Nykaa: Profit rose 66.3% to Rs 12.97 crore (vs. Rs 7.8 crore); revenue up 24.4% to Rs 1,874.7 crore (vs. Rs 1,507 crore); EBITDA grew 28.6% to Rs 103.7 crore, with margin at 5.55% (up 20 bps).

Bosch: Profit dropped 46.4% to Rs 536 crore (vs. Rs 999 crore); revenue up 6.4%

at Rs 4,394.3 crore; EBITDA up 14.1% at Rs 560.5 crore with a margin increase

to 12.8% (90 bps). Other income rose to Rs 208.9 crore; exceptional gains were

Rs 48.5 crore (vs. Rs 785 crore).

MedPlus: Profit surged 166% to Rs 38.7 crore (vs. Rs 14.5 crore); revenue grew 11.9% to Rs 1,576.2 crore.

Ashoka Buildcon: Profit jumped 334.1% to Rs 462.5 crore (vs. Rs 106.5 crore); revenue up 15.5% to Rs 2,488.9 crore.

PNC Infratech: Profit fell 43.6% to Rs 83.5 crore (vs. Rs 147.9 crore); revenue down 25.3% to Rs 1,427 crore.

Sula Vineyards: Profit decreased 37.3% to Rs 14.5 crore (vs. Rs 23.1 crore); revenue down 1.1% at Rs 141.2 crore.

Gujarat State Fertilizers & Chemicals: Profit dipped 3.5% to Rs 298.2 crore (vs. Rs 308.9 crore); revenue down 15.5% to Rs 2,635.2 crore.

DCX Systems: Profit down 73.7% to Rs 5.2 crore (vs. Rs 19.8 crore); revenue dropped 36.7% to Rs 195.6 crore.

EMS: Profit up 33.6% to Rs 49.7 crore (vs. Rs 37.2 crore);

revenue grew 13.2% to Rs 233.5 crore.

KEY STOCKS TO WATCH:

PNB Housing Finance: Quality Investment Holdings PCC plans to sell a 9.43% stake at Rs 939.3 per share, reducing its holding from the 19.87% held as of September 2024, according to CNBC-TV18.

Varun Beverages: The Board approved acquiring 100% of SBC Tanzania for $154.5 million (Rs 1,304 crore) and SBC Beverages Ghana for $15.06 million (Rs 127.1 crore), both PepsiCo franchise holders. Varun will also buy the remaining 39.93% in its subsidiary, Lunarmech Technologies, for Rs 200 crore, making it wholly-owned.

Tata Chemicals: Subsidiary Tata Chemicals Europe (TCEL) will

invest Rs 655 crore in a new UK plant with a 1,80,000 tons annual capacity for

pharmaceutical-grade sodium bicarbonate. To support this, TCEL will close its

Loss-making Lostock plant by January 2025.

FII/DII DATA:

1. FIIs net SOLD Rs 3,000 crore worth shares on 12 November.

2. DIIs net BOUGHT Rs 1,854 crore worth shares on 12 November.

Thank you, have a great Trading Day ahead!!