Latest StreetView

#STREETGAINS #MARKETSVIEW #08NOVEMBER2024

November 08, 2024

INDIAN MARKETS:

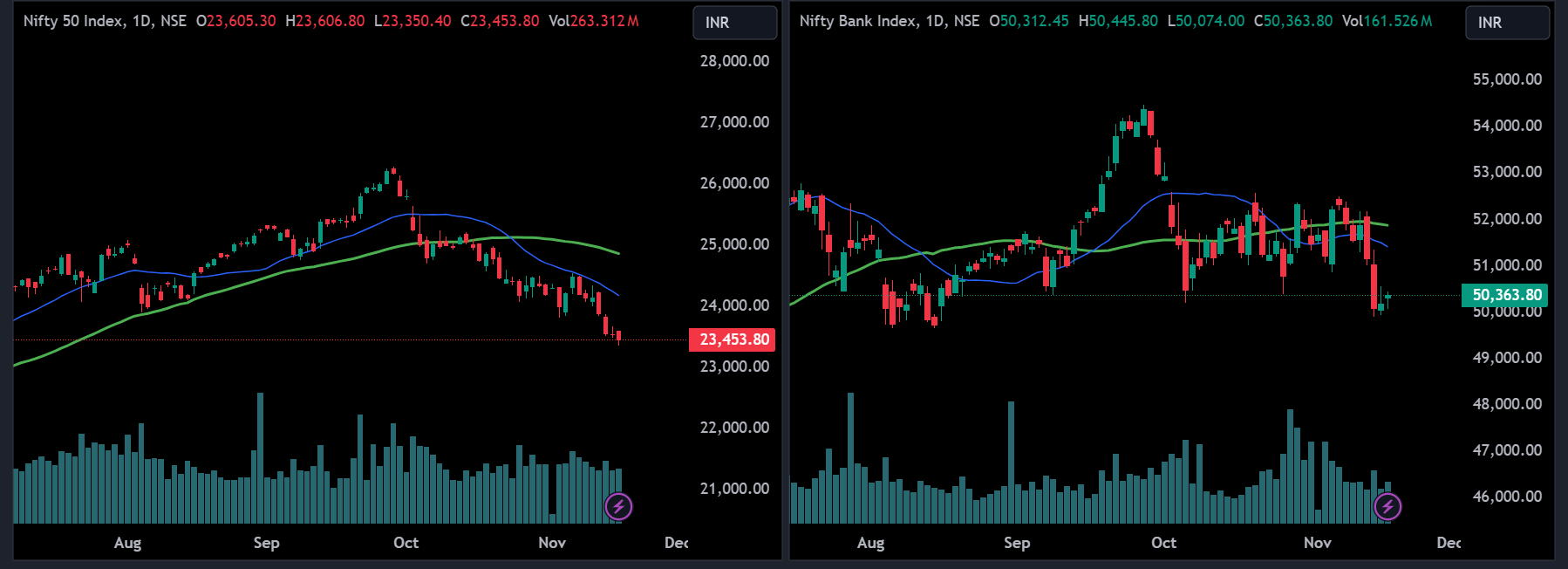

On November 07, At close, the Sensex was down 836.34 points or 1.04 percent at 79,541.79, and the Nifty was down 284.70 points or 1.16 percent at 24,199.30.

US MARKETS:

The Dow Jones Industrial Average fell 0.59 point, or flat, to 43,729.34, the S&P 500 gained 44.06 points, or 0.74%, to 5,973.10 and the Nasdaq Composite gained 285.99 points, or 1.51%, to 19,269.46.

ASIAN MARKETS:

The previous close saw the Topix increased by 0.17%, the Nikkei increased by 0.48%, and the Kospi increased by 0.80%.

OIL & GAS UPDATES:

US West Texas Crude decreased by 0.37%.

Brent Crude decreased by 0.28%.

KEY QUARTERLY EARNINGS:

Lupin Q2 (YoY): Profit up 74.1% to Rs 852.6 crore, revenue grows 12.6% to Rs 5,672.7 crore.

India Hotels Company Q2 (YoY): Profit surges 225.6% to Rs 582.7 crore, revenue rises 27.4% to Rs 1,826.1 crore, EBITDA up 41.3% to Rs 501.2 crore, margin expands 270 bps to 27.4%, exceptional gain of Rs 307.4 crore.

Emcure Pharmaceuticals Q2 (YoY): Profit increases 38.2% to Rs 201.5 crore, revenue rises 20.4% to Rs 2,002 crore, EBITDA up 15.8% to Rs 380.9 crore, margin dips 80 bps to 19%.

Rail Vikas Nigam Q2 (YoY): Profit declines 27.3% to Rs 287 crore, revenue falls 1.2% to Rs 4,855 crore, EBITDA down 9% to Rs 271.5 crore, margin drops 40 bps to 5.6%.

Emami Q2 (YoY): Profit up 17.2% to Rs 211 crore, revenue increases 3% to Rs 890.6 crore, EBITDA up 7.2% to Rs 250.5 crore, margin expands 110 bps to 28.1%.

Ircon International Q2 (YoY): Profit falls 17.9% to Rs 206 crore, revenue drops 19.3% to Rs 2,447.5 crore.

Indian Metals & Ferro Alloys Q2 (YoY): Profit rises 40.1% to Rs 125.2 crore, revenue down 0.1% to Rs 691.9 crore.

KEY STOCKS TO WATCH:

Wipro: The IT company has launched the Google Gemini Experience Zone to drive AI innovation for enterprises.

Embassy REIT: Ritwik Bhattacharjee appointed interim CEO. He was previously the company's Chief Investment Officer and a founding member of the 2019 listing team.

FII/DII DATA:

1. FIIs net SOLD Rs 4,888 crore worth shares on 07 November.

2. DIIs net BOUGHT Rs 1,786 crore worth shares on 07 November.