Intraday trading presents unparalleled opportunities for day traders and financial investors due to its fast-paced nature and high reward potential. However, this speed and volatility come with equally high risks. A single unfavourable market movement could lead to significant losses. This is where stop loss in intraday trading becomes an essential strategy.

Keep reading as we break down the concept of stop loss and how it can transform your trading sessions for the better.

What is a Stop Loss in Intraday Trading?

A stop loss is a predefined order to close your trade when the price moves against your position to a specified threshold. This automatic action prevents further losses by ensuring that your trade is exited at the specified price level.

For instance, if you purchase a stock at ₹100 and set your stop loss at ₹95, the trade will automatically close when the stock price falls to ₹95, safeguarding you from larger losses.

Stop loss is particularly crucial in intraday trading due to the unpredictability and rapid price fluctuations within the market. It acts as an insurance policy, providing traders with a safety net and ensuring their capital is protected.

Types of Stop Loss Orders

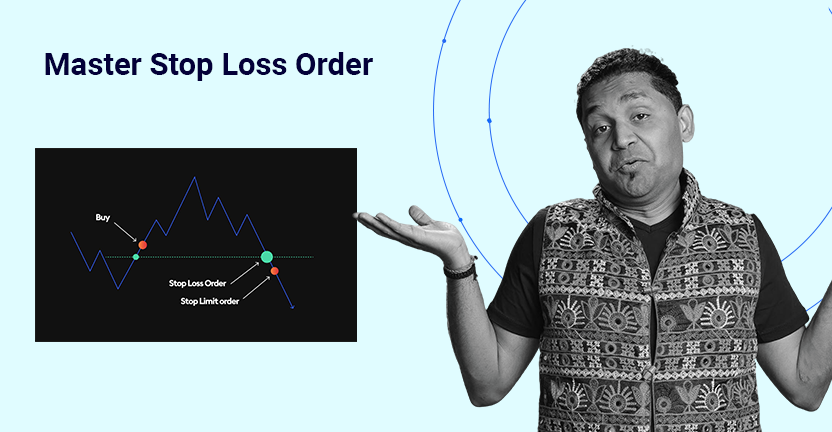

There are two main types of stop-loss orders in trading:

- Stop Loss Limit Order (SL)

- Combines a specific trigger price and a sell limit price.

- Ideal for those with precise control over the exit point.

- Stop Loss Market Order (SL-M)

- Includes only a trigger price, where the position is exited at the best available market price.

- Best used in highly volatile markets where immediate action is required.

How to Set a Stop Loss Effectively?

Using the right approach in setting stop-loss levels can make the difference between a successful intraday trade and a losing one. Here are some proven techniques tailored to stop loss in intraday trading:

1. Establish a Percentage Rule

A standard method is setting the stop loss order at a percentage of your entry price. For example, if you buy a stock for ₹200 and use a 2% stop loss, you’ll exit the trade if the price falls to ₹196.

2. Use Support and Resistance Levels

- For Long Positions: Place your stop loss just below the nearest support level.

- For Short Positions: Place it slightly above the nearest resistance level.

3. Swing Low and Swing High Strategy

- Swing low stop loss is placed where prices are predicted to rebound from a downward trend.

- Swing high stop loss is positioned for short-sellers when anticipating a reversal from upward momentum.

4. Understand Volatility

If you’re trading volatile stocks or indices, use wider stop losses to accommodate fluctuations. For low-volatility trades, narrower stop losses are more appropriate.

5. Trailing Stop Loss

- A trailing stop loss moves with the market’s favourable price shifts, locking in profits while limiting losses if the trend reverses.

- Example: If your entry price is ₹100 and your trailing stop loss is ₹5, it adjusts upwards as the price rises but stops further loss if the market falls substantially.

6. Set Realistic Targets

Calculate your risk-reward ratio before placing trades. A common standard is a 1:2 ratio, where your potential gain should be at least twice your maximum risk.

Examples of Stop-Loss Strategies

Example 1 – Long Trade

You purchase a stock at ₹150. Based on technical analysis, the stock’s support is identified at ₹145, and you set your stop loss just below it at ₹144. If the market declines to this level, your trade automatically closes, saving you from further downside risk.

Example 2 – Short Trade

You short-sell a stock at ₹180 and place your stop loss at ₹185 (above the resistance level). If the price moves against your position, the trade exits at ₹185, limiting your loss.

Common Mistakes to Avoid

While stop loss is a vital tool, its effectiveness depends on how well-implemented the strategy is. Avoid the following mistakes:

- Placing Stop Loss Too Tight

This can result in premature exits during typical price fluctuations.

- Using Broad Stop Losses

Wide stop loss levels can lead to unnecessarily large losses.

- Failing to Plan

Never enter a trade without predetermining your stop loss level.

Enhance Your Intraday Strategy with Discipline

Understanding and applying stop loss is not optional for intraday trading. It is a fundamental part of responsible trading, ensuring risks are managed while enabling you to take advantage of market opportunities efficiently.

Developing a reliable stop-loss strategy requires time, experience, and a data-driven approach. Streetgains provides well-researched trading insights, helping traders refine their strategies. With a credits-based subscription model, costs are only incurred for successful trade ideas, ensuring a performance-driven approach to investment decisions.

Disclaimer:

The content in this blog is intended for informational purposes only and does not constitute investment advice, stock recommendations, or trade calls by Streetgains. The securities and examples mentioned are purely for illustration and are not recommendatory.

Investments in the securities market are subject to market risks. Please read all related documents carefully before investing.

How to Use Stop Loss Order as an Effective Intraday Trading Idea? FAQs:

The primary purpose of a stop loss in intraday trading is to limit potential losses by exiting a trade automatically when the price moves unfavourably. It serves as a risk management tool, ensuring your capital is protected in volatile market conditions.

Choosing the proper stop loss level depends on factors like your risk tolerance, the stock’s volatility, and market conditions. Popular methods include using percentage rules, support and resistance levels, or swing high/low strategies for precision.

No, stop-loss orders cannot guarantee zero losses. There may be slippage in highly volatile markets or during events where prices move too quickly, potentially causing the trade to execute at a less favourable price than planned.

While it is not mandatory, using a stop loss in all trades is highly recommended, especially for intraday trading. It minimises risk and prevents significant losses, particularly in unpredictable or fast-moving markets.

A stop-loss limit order triggers a trade at your specified price or better. A stop-loss market order, on the other hand, exits the trade at the best available market price after reaching the trigger point, ensuring faster execution.

Yes, trailing stop losses can help maximise profits by moving with favourable market trends. They lock in profits as the price rises while still guarding against losses if the trend reverses significantly.

The main risks include slippage during high volatility, setting stop losses too tight (leading to premature exits), or placing them too wide (causing larger losses). Proper planning and execution are key to mitigating these risks.

Improving your stop-loss strategy takes research, discipline, and expertise. You need to analyse market trends, understand technical indicators, and adapt to the volatility of your assets. With Streetgains and our data-driven insights and suggestions tailored to your goals, you’ll get well-researched ideas with precise stop-loss levels.

FAQs:

-

1. How to earn money daily from trading?

Earning money daily from trading involves strategies like day trading, where traders capitalise on small price movements within the same day. Success requires real-time market analysis, quick decision-making, and risk management.

-

2. How to earn money from equity trading?

To earn money from equity trading, you need to buy stocks at a lower price and sell them at a higher price. Success depends on researching companies, analysing stock trends, and using technical or fundamental analysis.

-

3. How to earn money from share trading in India?

In India, share trading offers profit potential through buying and selling stocks on exchanges like the NSE and BSE. To maximise returns, traders should use market research, tools like technical analysis, and risk management strategies.

-

4. How to make money from share trading in India?

Making money from share trading involves selecting the right stocks, timing the market, and implementing trading strategies like swing trading or day trading while staying informed about market trends.

-

5. How to transfer money from a trading account to a bank account?

To transfer money from your trading account to your bank, log into your trading platform, navigate to the funds section, and initiate a withdrawal request. The money will typically be credited to your linked bank account in 1 to 3 days.

-

6. How to withdraw money from a trading account?

You can withdraw funds by logging into your trading account, selecting the withdrawal option, and selecting the amount to transfer to your bank account. Ensure your bank account is linked and follow any steps your broker requires.

Subscribe to our Credits-Based Research System:

Pay only for successful research calls!