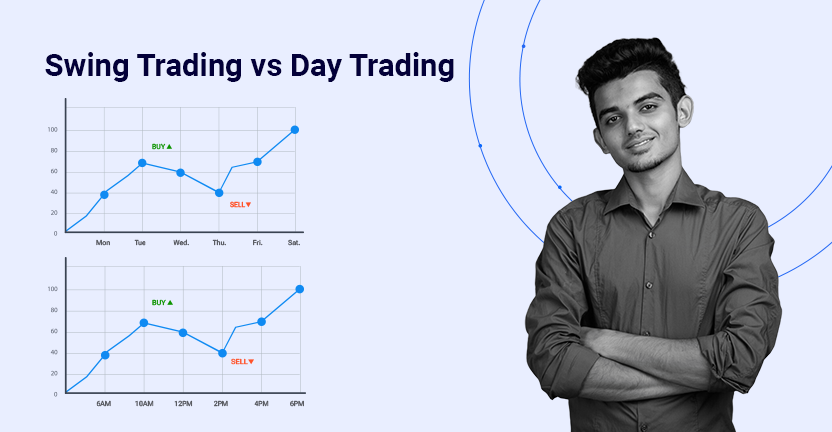

Day trading and swing trading are two widely practised trading strategies in the stock market. While day trading focuses on quick intraday opportunities, swing trading targets medium-term price movements over days or weeks. Understanding their differences will help determine which strategy aligns with your financial goals and time commitment. This blog explores these two popular trading strategies to help you make an informed decision.

What Is Day Trading, and how does it work?

- Day trading involves executing multiple trades within the same day, with positions closed before the market closes. It relies on quick decision-making and suits traders who can monitor the market throughout the day.

- Day traders often utilise technical analysis, real-time market data, and high-speed trading platforms to identify and act on price movements. This strategy is ideal for high volatility and liquidity markets, providing frequent trading opportunities.

- However, day trading requires significant capital due to frequent transactions and margin requirements. The high-pressure environment also demands discipline and emotional resilience.

What are the Advantages and Disadvantages of Day Trading?

Advantages of Day Trading

- No Overnight Risk: Day trading eliminates the risk of unexpected market events as all positions are closed by the end of the trading session.

- Frequent Opportunities: Active market movements during the day provide multiple opportunities for traders to act.

- Immediate Results: Trades are executed and settled quickly, providing faster decision feedback.

- Utilisation of High Volatility: Day traders can benefit from sharp price movements in volatile markets.

- High Liquidity Focus: Day trading typically involves liquid stocks, ensuring ease of entry and exit.

Disadvantages of Day Trading

- Significant Time Commitment: Day trading requires active monitoring of markets throughout the trading day, making it a full-time endeavour.

- Higher Transaction Costs: Frequent trades result in increased brokerage fees and expenses.

- Stressful Environment: The fast-paced nature of day trading can be mentally and emotionally demanding.

- High Capital Requirement: Margin requirements and frequent trading necessitate substantial capital to operate effectively.

- Steep Learning Curve: Day trading demands strong technical analysis skills, quick decision-making, and emotional discipline, which can be challenging for beginners.

What Is Swing Trading, and how does it work?

- Swing trading is a medium-term strategy where traders hold positions for a few days to weeks to benefit from market trends and price swings. Unlike day trading, it does not require constant market monitoring, making it suitable for part-time traders.

- Swing traders combine technical indicators and fundamental analysis to identify entry and exit points. Tools like trendlines, moving averages, and news events are commonly used.

- While swing trading involves less stress and fewer trades, it carries overnight market risks. This strategy suits traders who prefer a slower pace and have patience for developing trades.

What are the Advantages and Disadvantages of Swing Trading?

Advantages of Swing Trading

- Flexibility: Swing trading does not require constant monitoring, making it ideal for part-time traders with other commitments.

- More significant Success Potential: Holding positions for a few days or weeks allows traders to capture more considerable price movements than intraday trades.

- Lower Transaction Costs: Fewer trades mean reduced brokerage fees and transaction costs over time.

- Less Stressful: Unlike day trading, swing trading offers a slower pace, reducing the pressure of constant decision-making.

- Combines Fundamental and Technical Analysis: Swing traders can benefit from both types of analysis to enhance decision-making.

Disadvantages of Swing Trading

- Overnight Risks: Holding positions overnight exposes traders to unexpected market events or news risks.

- Requires Patience: Swing trading demands the discipline to wait for trades to develop, which can be challenging for impatient traders.

- Possibility of Missed Opportunities: Swing traders may miss short-term price fluctuations that offer quick gains.

- Moderate Capital Requirements: While not as capital-intensive as day trading, swing trading still requires sufficient funds to hold positions for longer durations.

- Complex Decision-Making: Combining multiple forms of analysis can be overwhelming for beginners or those without a clear strategy.

What Are the Key Differences Between Day Trading and Swing Trading?

| Aspect | Day Trading | Swing Trading |

| Time Frame | Intraday: Positions closed by the end of the day | Held for days to weeks |

| Time Commitment | Full-time engagement during market hours | Part-time; occasional monitoring |

| Risk Management | Requires quick, real-time adjustments | Planned, gradual decision-making |

| Capital Requirements | Higher due to frequent trades and margin use | Moderate, with fewer trades |

| Market Conditions | High volatility preferred | Trending or stable markets are ideal |

| Gains Per Trade | Smaller gains per trade; frequent trades | More significant gains per trade; fewer trades |

Which Strategy Should You Choose?

The choice between day trading and swing trading ultimately depends on your preferences, financial objectives, and the time you can dedicate to trading. Here’s a closer look at how to decide:

Choose Day Trading If:

- You can commit to actively monitoring the market during trading hours.

- You thrive in a fast-paced environment and are comfortable making quick decisions under pressure.

- You have sufficient capital to handle frequent trades and meet margin requirements.

- You prefer shorter time frames, quick results, and frequent trading opportunities.

- You are experienced with technical analysis and can manage the emotional stress of rapid market fluctuations.

Opt for Swing Trading If:

- You have other commitments and prefer a part-time approach to trading.

- You are patient and can wait for trades to develop over days or weeks.

- You want to minimise the stress of constant monitoring while still capturing meaningful price movements.

- You prefer combining technical and fundamental analysis for longer-term trends.

- You have moderate capital and aim to reduce transaction costs with fewer trades.

Choose the strategy that aligns with your goals, time, and risk tolerance, and commit to disciplined risk management for long-term success.

Conclusion: Finding Your Ideal Trading Strategy

Day and swing trading offer unique approaches to engaging with the stock market. Day trading suits those who can dedicate full-time focus and thrive in fast-paced environments, while swing trading appeals to individuals seeking flexibility and moderate trading activity.Streetgains provides well-researched insights and data-driven tools to help traders optimise their strategies and make informed decisions. Regardless of your chosen plan, focus on disciplined risk management and clear financial goals to enhance your trading success.

Disclaimer:

The content in this blog is intended for informational purposes only and does not constitute investment advice, stock recommendations, or trade calls by Streetgains. The securities and examples mentioned are purely for illustration and are not recommendatory.

Investments in the securities market are subject to market risks. Please read all related documents carefully before investing.

Day Trading vs. Swing Trading: Which Strategy is Best for You? FAQs:

Day trading involves intraday trades, with positions closed by the end of the day. Swing trading spans multiple days or weeks, aiming to capture broader price movements.

Day trading suits active traders who can dedicate full-time attention, while swing trading is better for those seeking flexibility and less frequent trading.

Day trading operates within the same day, while swing trading involves holding positions for days to weeks.

Day trading thrives in highly volatile and liquid markets. Swing trading performs well in trending or stable market conditions.

Day trading typically requires higher capital due to frequent trades and margin use. Swing trading demands moderate capital as it involves fewer trades.

Swing trading is often more suitable for beginners, as it is less demanding in time and stress than day trading.

Both require an understanding of technical analysis, risk management, and market trends. Day trading demands quick decision-making, while swing trading benefits from patience.

Streetgains provides actionable, well-researched insights and tools to help traders optimise their trading strategies and achieve their financial goals.

FAQs:

-

1. How to earn money daily from trading?

Earning money daily from trading involves strategies like day trading, where traders capitalise on small price movements within the same day. Success requires real-time market analysis, quick decision-making, and risk management.

-

2. How to earn money from equity trading?

To earn money from equity trading, you need to buy stocks at a lower price and sell them at a higher price. Success depends on researching companies, analysing stock trends, and using technical or fundamental analysis.

-

3. How to earn money from share trading in India?

In India, share trading offers profit potential through buying and selling stocks on exchanges like the NSE and BSE. To maximise returns, traders should use market research, tools like technical analysis, and risk management strategies.

-

4. How to make money from share trading in India?

Making money from share trading involves selecting the right stocks, timing the market, and implementing trading strategies like swing trading or day trading while staying informed about market trends.

-

5. How to transfer money from a trading account to a bank account?

To transfer money from your trading account to your bank, log into your trading platform, navigate to the funds section, and initiate a withdrawal request. The money will typically be credited to your linked bank account in 1 to 3 days.

-

6. How to withdraw money from a trading account?

You can withdraw funds by logging into your trading account, selecting the withdrawal option, and selecting the amount to transfer to your bank account. Ensure your bank account is linked and follow any steps your broker requires.

Want Daily Stock Recommendations That Are Generated By Our Analysts ?

Join 3 Lakh+ Investors who have tried our Services